Jordan Ross Belfort is an American entrepreneur, speaker, author, former stockbroker, and financial criminal. He published the memoir “The Wolf of Wall Street” in 2007, adapted into a Martin Scorsese film of the same name released in 2013, in which Leonardo DiCaprio played him.

Content of This Article

- Jordan Belfort’s Appearance

- Facts About Jordan Belfort

- Jordan Belfort’s Net Worth

- Early Life

- Jordan Belfort’s Wife and Family

- Jordan Belfort’s Career

- Jordan Belfort’s Assets & Investments

- Jordan Belfort’s Controversy

Jordan Belfort’s Appearance (Height, Hair, Eyes & More)

| Height | 1.7 m |

| Weight | 67 kg |

| Hair Color | Dark Brown |

| Eye Color | Blue |

| Body Type | Athletic |

| Sexual Orientation | Straight |

Facts About Jordan Belfort

| Nationality | American |

| Estimated Net Worth | $115 million |

| Religion | Christian |

| Zodiac Sign | Cancer |

| Birthplace | The Bronx, New York City |

| Birthday | July 9, 1962 |

Jordan Belfort’s Net Worth

Jordan Belfort’s net worth in 2023 is estimated at $115 million (via CA Knowledge). This is mainly due to the income from speaking engagements, memoir sales, and the assets he retains — a $27 million home, luxury cars, and more.

Early Life

Jordan Belfort was born to Jewish parents in the Bronx borough of New York City on July 9, 1962. His parents, Max and Leah, were both accountants. His upbringing was in Bayside, Queens. Between completing high school and beginning college, Belfort and his close childhood companion Elliot Loewenstern earned $20,000 selling Italian ice from Styrofoam coolers to beachgoers.

Education

Belfort went on to earn a degree in biology from American University. He enrolled at the University of Maryland School of Dentistry. On the first day, the dental school dean gave a welcome address in which he stated, “The golden age of dentistry is over.” If you’re only here to make a lot of money, you’ve come to the incorrect place. Then, Belfort decided not to enroll in the graduate program.

Jordan Belfort’s Wife and Family

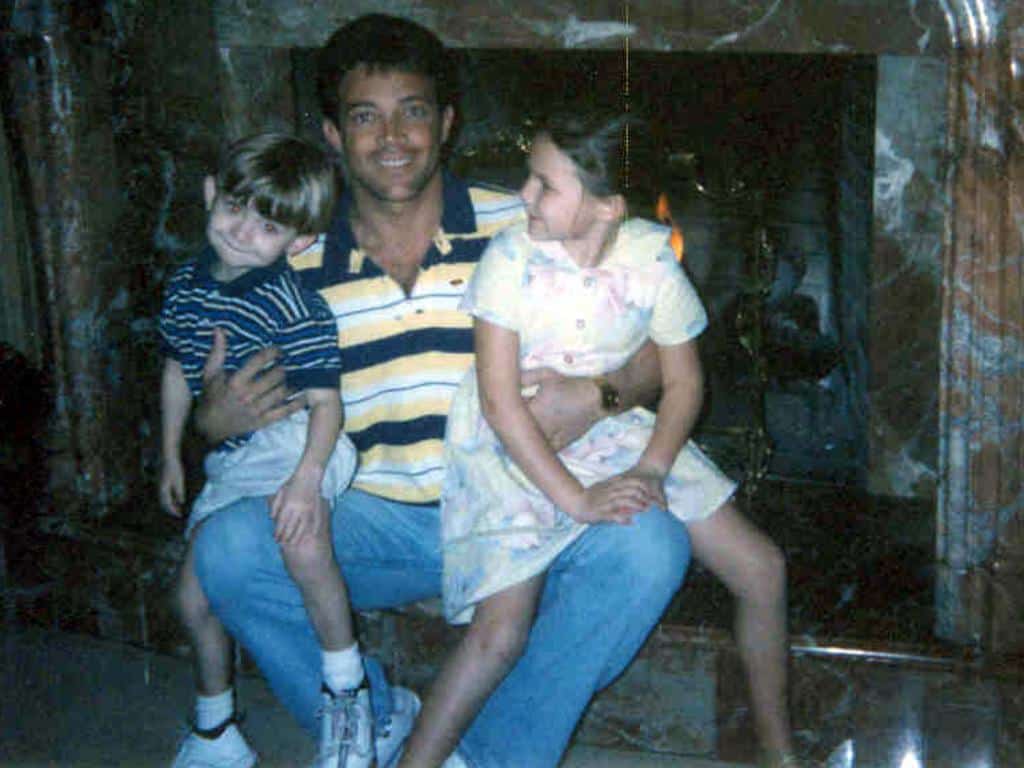

During his tenure as CEO of Stratton Oakmont, Belfort and his first wife, Denise Lombardo, divorced. Later, he married Nadine Caridi, a model born in the United Kingdom and reared in Bay Ridge, Brooklyn. She bore him two children. Following her allegations of domestic violence, which were fueled by his drug addiction and infidelity, Belfort and Caridi ultimately separated. They split up in 2005.

Belfort was the last proprietor of the 1961-built luxury yacht Nadine, initially constructed for Coco Chanel. The yacht was given the moniker Caridi. In June 1996, the yacht sank off the coast of eastern Sardinia, and combat divers from the Italian Navy’s special forces unit COMSUBIN rescued everyone on board. Belfort stated that, against the advice of his captain, he persisted in sailing out in high winds, resulting in the ship’s sinking when waves smashed the foredeck hatch. A hacker stole $300,000 of digital tokens from Belfort’s cryptocurrency wallet in the autumn of 2021. Belfort is an enthusiastic tennis player.

Jordan Belfort’s Career

Early Ventures

Jordan Belfort sold meat and seafood door-to-door on Long Island, New York. In interviews and his memoirs, he asserts that the business was initially successful; he grew his meat-selling business to employ several individuals and sell 5,000 pounds (2,300 kilograms) of beef and salmon per week. The enterprise ultimately failed, and at age 25, he declared bankruptcy. According to his memoirs and interviews, a family acquaintance assisted him in obtaining a position as an apprentice stockbroker at L.F. Rothschild. Belfort claims he was laid off due to the firm’s financial difficulties caused by the 1987 Black Monday stock market collapse.

Stratton Oakmont

Jordan Belfort established “Stratton Oakmont” as a franchise of Stratton Securities and subsequently acquired the original proprietor. Stratton Oakmont was a boiler room that sold penny stocks and defrauded investors through “pump and dump” stock transactions. During his time at Stratton, Belfort threw lavish parties and abused recreational drugs, particularly methaqualone (sold under the brand name “Quaalude”), which led to an addiction. Stratton Oakmont employed over 1,000 stock brokers and was involved in stock issues aggregating over $1 billion, including the initial public offering for footwear company “Steve Madden.” Throughout its history, law enforcement officials targeted the company, and its notoriety inspired the films “Boiler Room” (2000) and “The Wolf of Wall Street” (2013).

Since 1989, the National Association of Securities Dealers (now the Financial Industry Regulatory Authority) has closely monitored Stratton Oakmont. The NASD expelled Stratton Oakmont in December 1996, forcing it out of business. In 1999, Belfort was charged with securities fraud and money trafficking.

Belfort was sentenced to four years in prison on July 18, 2003. In exchange for a plea agreement with the Federal Bureau of Investigation, Belfort served 22 months at the Taft Correctional Institution in Taft, California, for running pump-and-dump schemes that resulted in approximately $200 million in investor losses. Belfort was ordered to repay the stock purchasers he defrauded of $110.4 million. While serving his sentence, Belfort shared a cell with Tommy Chong, who encouraged him to write about his experiences as a stockbroker. After their release from prison, they remained companions, with Belfort crediting Chong for his new career path as a motivational speaker and author.

At a motivational talk that he delivered in Dubai, United Arab Emirates, on May 19, 2014, Belfort stated: “I got greedy. … Greed is not good. Ambition is good, and passion is good. Passion prospers. My goal is to give more than I get; that’s a sustainable form of success. … Ninety-five percent of the business was legitimate. … It was all brokerage firm issues. It was all legitimate, nothing to do with liquidating stocks. However, federal prosecutors and SEC officials involved in the case have said, “Stratton Oakmont was not a real Wall Street firm, either literally or figuratively.”

Restitution

Jordan Belfort’s restitution agreement required him to pay 50 percent of his income toward restitution to the 1,513 clients he defrauded until 2009, in addition to a total of $110 million. In 2013, approximately $10 million of the $110 million recovered by Belfort’s victims resulted from the sale of forfeited properties.

Federal prosecutors complained about Belfort in October 2013. Several days later, the U.S. government withdrew its motion to declare Belfort in default of his payments after his attorneys argued that he was only obligated to pay 50% of his salary to restitution until 2009 and not since. He paid $382,910 in restitution during his parole period (after leaving prison) in 2007, $148,799 in 2008, and $170,000 in 2009. After this period, Belfort began negotiating a restitution payment schedule with the United States government.

After a judge ruled that Belfort was not required to pay 50% of his income beyond the end of his parole, the final agreement between Belfort and the government stipulated that he would pay a minimum of $10,000 per month for the remainder of his life towards restitution. Belfort has claimed that he is additionally putting the proceeds from his U.S. public speaking engagements and media royalties towards the restitution and the $10,000 monthly.

Prosecutors also claimed that he fled to Australia to avoid taxes and conceal his assets from his victims. Still, they later recanted their statement to The Wall Street Journal by issuing Belfort an official apology and requesting that The Wall Street Journal publish a retraction.

Additionally, Belfort claimed on his website and elsewhere that he planned to request that “100% of the royalties” from his books and The Wolf of Wall Street film be donated to victims. In June 2014, however, spokespeople for the U.S. attorney stated that Belfort’s claim was “not factual” and that he had received funds from the initial sale of the movie rights that were not all applied to his restitution repayment.

According to BusinessWeek, Belfort had only paid $21,000 toward his restitution obligations out of the approximately $1.2 million paid to him before the film’s release. According to Belfort, the government refused his offer to contribute 100 percent of the proceeds from his book contract to his restitution.

Cryptocurrency

Previously, Belfort was skeptical of cryptocurrencies, describing Bitcoin as “fricking insanity” and “mass delusion.” As Belfort learned more about cryptocurrencies and their prices skyrocketed, he altered his mind. Belfort has declined offers to create Wolf-themed N.F.T.s despite claiming “[he] could easily make $10 million.” Belfort has also stated that he is “extremely excited” for cryptocurrency regulation. Currently, Belfort is an investor in multiple cryptocurrency startups.

Writing

Jordan Belfort wrote the memoirs “The Wolf of Wall Street” and “Catching the Wolf of Wall Street,” which were published in approximately 40 countries and translated into 18 languages. A film based on his books opened in 2013 starring Leonardo DiCaprio (as Belfort), Jonah Hill, and Margot Robbie; the film was written by Terence Winter and directed by Martin Scorsese.

He wrote his first book in the days following his release from prison (after a false start during his sentence when he wrote and destroyed 130 initial pages). He received a $500,000 advance from Random House, and before its release, a bidding war began for the book’s film rights. The former federal prosecutor who led the criminal investigation of Belfort said that he “invented much,” that “he aggrandized his importance and reverence for him by others at his firm,” and that “The real Belfort story still includes thousands of victims who lost hundreds of millions of dollars that they never will be repaid.”

In 2017, he wrote “Way of the Wolf: Straight Line Selling: Master the Art of Persuasion, Influence, and Success.” It details the sales technique he used alongside his team of brokers while operating on Wall Street.

Motivational Speaking

Belfort has given motivational speeches. This has included a tour of live seminars in Australia entitled “The Truth Behind His Success,” in addition to other appearances. In a 60 Minutes interview regarding his new career, Belfort stated of his previous life that his “greatest regret is losing people’s money.” He also runs sales seminars entitled “Jordan Belfort’s Straight Line Sales Psychology.” When he first began speaking, he focused mainly on motivation and ethics, then moved to sales skills and entrepreneurship.

His speaking engagements are run through his business, Global Motivation Inc., and, as of 2014, Belfort was spending three weeks out of each month on the road for speaking engagements. The central theme of his speeches includes the importance of business ethics and learning from his mistakes during the 1990s—such as believing that he was justified in skirting the rules of financial regulators simply because it was expected. His per-engagement speaking fees have been about $30,000–75,000, and his per-sales seminar fee can be $80,000 or more.

The primary subject matter of his seminars is what he has called the “Straight Line System,” a system of sales advice. Some reviewers have reacted negatively to the content of the speeches, specifically, Belfort’s recounting of stories from the 1990s.

Jordan Belfort’s Assets & Investments

The assets of Jordan Belfort include 12 real estate properties, nine automobiles, and three luxury yachts. Jordan Belfort’s Assets Portfolio also includes over $32 Million in cash reserves. Additionally, Jordan Belfort possesses a portfolio of eight stocks valued at $15 million. A few of the stocks owned by Jordan Belfort are Visa, Walmart, Apple, FedEx, and General Motors.

Cars

Recently, Jordan Belfort purchased a brand-new Alfa Romeo Giulia for USD 90,000. Additionally, Jordan Belfort possesses a Jaguar XE valued at over USD 125,000. A few other cars owned by Jordan Belfort are listed below, along with their prices:

- Lexus ES – USD 135,000

- Ferrari Portofino – $700,000 USD

- Bugatti Chiron – $3 Million USD

House

Jordan Belfort lives in a 10,000-square-foot luxury home in New York. Jordan Belfort bought this house for USD 27 million.

Jordan Belfort’s Controversy

He pleaded guilty to fraud and associated charges 1999 concerning manipulating the stock market and operating a boiler room as part of a penny stock scheme. As part of an arrangement, Belfort served 22 months in prison in exchange for providing testimony against numerous associates and employees who participated in his fraud operation.

Australian Training Scandal

An investigation led by 7News and The Sunday Mail uncovered links between Belfort and employment company Career Pathways Australia, run by Paul Conquest, who also has majority ownership of Face to Face Training. The two brands were heavily promoted at Belfort workshops at Brisbane‘s Eatons Hill Hotel. Belfort reportedly gave two sales workshops for the face-to-face training staff.

Face-to-face training received $3.9 million from the state government during FY 2014 and $6.34 million during FY 2015 for its training and assessment services. Much of this money was expected to be spent on service training and certification, which did not happen. 9 News Australia called the training program a scam and the certification program a “tick and flick” in its 60 Minutes segment.